Policy Reward: Protecting Your Ride, Securing Your Journey

Your vehicle Your Coverage: Personalized Auto Insurance Plans

Why Choose Us?

Overview

Welcome to Policy Reward's Automobile Insurance – your gateway to comprehensive protection for your vehicles. In the ever-changing world of driving, having the right auto insurance is not just a legal requirement but a crucial asset for your peace of mind. At E-Insure First, we understand that every driver is unique, and so are their insurance needs.

That's why we offer tailored automobile insurance solutions designed to fit your specific circumstances. With our commitment to excellence, competitive rates, and responsive support, we aim to be your trusted partner on the road.

Automobile Insurance and its types

Automobile insurance is your shield against the unexpected on the road. It's a pact between you and your insurer that ensures financial protection in case of accidents, damage, or theft. By paying regular premiums, you secure comprehensive coverage, including repairs, liability, and even a replacement vehicle if needed. Automobile insurance offers peace of mind, allowing you to navigate the highways with confidence. Policy Reward simplifies auto insurance, providing you with tailored coverage and responsive support for a worry-free ride.

Benefits of Automobile Insurance

Explore the Many Ways Insurance Safeguards Your Life

Factors That Determine Automobile Insurance

-

Driving Record

-

Type of Vehicle

-

Location

-

Usage

-

Coverage Type

-

Deductible

-

Credit Scorer

-

Annual Mileage

-

Discounts

-

Lapse in Coverage

-

Age of Drivers

-

Previous Claims History

Top 10 Companies That Provide Automobile Insurance In India

What Is Not Covered

Racing or Reckless Driving

Driving Without a Valid License

DUI or Illegal Activities

Unauthorized Drivers

Off-Road Use

Unreported Modifications

Acts of War or Terrorism

Natural Disasters

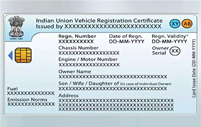

Essential Documents for Automobile Insurance Coverage

Vehicle Registration Certificate

Driver's License

Address Proof

Vehicle Purchase Invoice (for new vehicles)

Bank Details

Personal Identification

FAQs

What Our Clients Say About Us

Neha S.

Amit P

Policy Reward's automobile insurance has been a lifesaver. Their coverage options are extensive, and their rates are fair. When my car needed repairs, they were quick to assist, making a stressful situation manageable. It's reassuring to know that I have a reliable partner in Policy Reward, not just for insurance coverage but also for their unwavering support when I needed it the most.

Priya G.

Whenever I had inquiries or required assistance with my Policy Reward auto insurance, their team exhibited responsiveness and professionalism. They consistently offered clear and comprehensive explanations about policy details, coverage parameters, and the steps involved in filing claims. Policy Reward sets the gold standard for customer service in the insurance industry.

Adding my new car to my Policy Reward policy was a breeze. They made it simple and cost-effective. Their customizable policies let me tailor coverage to my needs. Plus, their customer support team is always there when I have questions. Policy Reward is my trusted partner for automobile insurance